Вавада казино вход и регистрация

Проект был запущен в 2017 году по задумкам обычного игрока в казино Макса Блэка. Идеи гемблера были связаны с предоставлением пользователям простого и минималистичного интерфейса с легкой навигацией на всех страницах ресурса. Изначально, вавада вход был доступен для русскоязычного комьюнити гемблеров, но затем проект стал добиваться успехов на глобальном уровне по всему миру. Свидетельством прогресса можно назвать количество языковых версий платформы на сегодняшний день – 19.

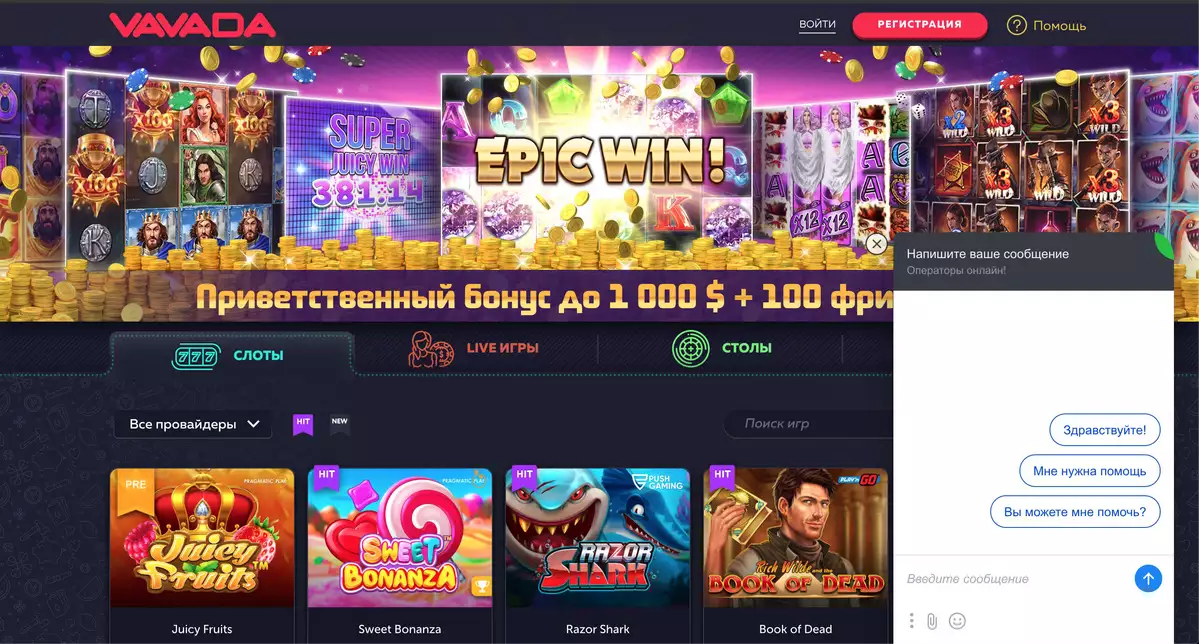

Главная страница наполнена всем необходимым контентом для новичков в индустрии онлайн гемблинга и имеет заманчивые кейсы опытным пользователям, которые желают открыть аккаунт на надежной площадке. Вас встречает темный фон, на котором отлично выделяются нужные кнопки для регистрации и авторизации в личный кабинет, красочные баннеры с ключевыми предложениями компании, а также яркое игровое портфолио. В горизонтальном меню после картинок найдете четыре опции – игровые автоматы vavada, лайв казино, столы и турниры. По умолчанию после клика на соответствующий раздел система отображает наиболее популярные тайтлы и новинки жанров.

Сразу после игрового ассортимента компания предлагает пользователям ознакомиться с футером и полезными функциями:

- Написать нам. Эта опция открывает все действующие способы связи с представителями службы поддержки.

- Правила и условия. Одним кликом знакомитесь с действующими положениями по гемблингу и получаете важную дополнительную информацию по бонусам, играм, турнирам и джекпотам.

- Ответственная игра. Прочитав эту статью, вы увеличите шансы на положительный пользовательский опыт при ставках на азартные игры и сведете к минимуму риски стать зависимыми от азарта.

- Социальные сети. Вы можете легко перейти на актуальные страницы клуба в соцсетях, получать различные подарки и участвовать в розыгрыше полезных функций.

- Платежи. Внизу страницы увидите все актуальные методы платежей, с которыми игроки пополняют баланс и выводят деньги.

Отмечаем, что vavada casino официальный сайт более шести лет действует в сфере онлайн гемблинга легально (во многих странах мира) благодаря лицензии Кюрасао.

| 🕹️ Игровая платформа | Вавада |

| 🎯Дата открытия | 13.10.2017 |

| 🎰 Топовые провайдеры | NetEnt, Igrosoft, Novomatic, Betsoft, EGT, Evolution Gaming, Thunderkick, Microgaming, Quickspin |

| 🃏Тип казино | Браузерная, мобильная, live-версии |

| 🍋Операционная система | Android, iOS, Windows |

| 💎Приветственные бонусы | 100 фриспинов + 100% к первому депозиту |

| ⚡Способы регистрации | Через email, телефон, соц. сети |

| 💲Игровые валюты | Рубли, евро, доллары, гривны |

| 💱Минимальная сумма депозита | 50 рублей |

| 💹Минимальная сумма выплаты | 1000 рублей |

| 💳Платёжные инструменты | Visa/MasterCard, SMS, Moneta.ru, Webmoney, Neteller, Skrill |

| 💸Поддерживаемый язык | Русский |

| ☝Круглосуточная служба поддержки | Email, live-чат, телефон |

Регистрация аккаунта Вавада

Компания дает отличную навигацию не только через ПК/ноутбуки, но и на мобильной платформе. Все элементы для гемблинга оптимизированы под мобильные браузеры, в том числе вавада регистрация профиля. В обеих площадках вам нужно кликнуть на красную кнопку в верхней части интерфейса и открыть анкету для указания следующих данных:

- Логин – номер мобильного или адрес электронной почты;

- Пароль;

- Валюта – поддерживаются наиболее популярные денежные единицы;

- Согласие с правилами заведения.

Подтвердив регистрацию, вы можете выполнить первый вход в личный кабинет. Нажимаете на кнопку «войти» и вводите логин с паролем. В настройках ЛК вы получаете возможности указать дату рождения для дальнейшего подарка, пополнять счет и выводить выигрыши, запускать переписку с саппортом, включать промокоды и бонусы, а также отслеживать текущий статус вавада. На платформе действует шесть уровней для пользовательского аккаунта, с каждой прокачкой вы получаете улучшенные условия гемблинга. В таблице ниже представляем ключевые нюансы каждого статуса:

| Уровень | Описание | Сумма ставок в месяц (в USD) |

| Новичок | Все зарегистрированные гемблеры получают данный статус гарантированно. Вывод средств лимитирован одной тысячью долларов, уровень позволяет входить в турниры с минимальными требованиями (новичок). | 0 |

| Игрок | Отличия минимальны от гарантированного уровня за регистрацию профиля. | 15 |

| Бронзовый | Бетторы получают возможность участвовать в новой серии турниров на фриспины, специально разработанные для бронзовых. Лимит на снятия выигрышей поднят до 15 тысяч долларов. | 250 |

| Серебряный | Вы входите в турниры вавада для серебряных игроков. Максимально можете выводить средства до 20K$. | 4000 |

| Золотой | Эксклюзивный вход в соревнования по фриспинам для золотых пользователей, увеличенный лимит на снятие денег – ло 30000 USD. | 8000 |

| Платиновый | Участие в VIP-турнирах; Лимит на вывод – 100000$; Поддержка личного менеджера в любом удобном мессенджере. | 50000 |

Выделяем, что после создания учетной записи вы без лишних хлопот вносите депозиты, делаете ставки в игровом портфолио и снимаете выигрыши. Даже при процессе вывода от вас не потребуется верификация учетки, проверку личности игрока компания запустит только по негативным кейсам – подозрения на нечестный гемблинг, использование сторонних программ для взлома слотов, несколько аккаунтов под разными именами и другие нюансы мошеннической деятельности.

Вавада регистрацияКак играть в казино Вавада

Новичкам даем главный совет – не нужно торопиться и сразу вносить реальные деньги на счет. Сначала нужно потратить время, прочитать все правила и условия, которые сайт vavada опубликовал в своем футере. Далее – ознакомьтесь с положениями по ответственному гемблингу, чтобы каждый раз подходить к игре с высоким уровнем личной ответственности и делать ставки на холодную голову и разумно.

Компания дает отличные возможности получать удовольствие в процессе бетов и не рисковать собственными деньгами – демонстрационный режим. Эта функция представлена во всех игровых автоматах и аркадах, вы ставите без риска, наслаждаетесь игровым процессом и будете знать, какие игры выдают лучшие плюсы, когда соберетесь ставить с реального денежного баланса.

Обязательно поинтересуйтесь у службы поддержки, какие блогеры являются партнерами бренда и получите ссылки на их стримы. Вы можете сами поискать игровой процесс на сайте вавады в популярных стриминговых платформах и посмотреть, как играют другие опытные гемблеры.

Если принимаете решения ставить реально, то советуем не гнаться за крупными выигрышами и хайроллить. Помните ключевое правило: играйте только на ту сумму, которую можете позволить себе для проигрыша. Следуя указанным советам, у вас будет положительный опыт игры в азартные развлечения и повышенные шансы остаться в плюсе после сессий.

Список рабочих зеркал Вавада

Ассортимент казино Vavada

Игровое портфолио клуба предлагает захватывающий процесс размещения ставок бесплатно и на реальные деньги в слотах, live casino, столах и аркадах. Множество игр участвуют в качестве квалификационных во время проведения турниров. Ниже представляем все актуальные разделы для гемблинга на платформе.

Лучшие слоты на Вавада

| 🔥 Бездепозитный бонус: | 100 фриспинов |

| 💻 Официальный сайт: | vavada.com |

| 🎲 Тип казино: | Слоты, Столы, Live, Турниры |

| 🗓 Рабочее зеркало: | Есть |

Игровые автоматы

Открыть игровые автоматы вавада предлагается кликом на опцию слоты в горизонтальном меню. Здесь компания на регулярной основе интегрирует только официальные решения от надежных разработчиков, число которых на площадке уже составляет 44. В слоты включены наиболее популярные решения с вайлдами (липкие, расширяющиеся), скаттерами, выдающими крупные Х от прокрутки и запускающими фриспины, множителями выигрышей, функцией tumble и другими полезными опциями для огромного плюса. В слоты имеете возможность поиграть бесплатно в демо-режиме. Регулярно 4500+ аппаратов обновляются новыми в статусе пре-релиза, эти игры редко можно увидеть на других площадках до официального запуска со стороны провайдера.

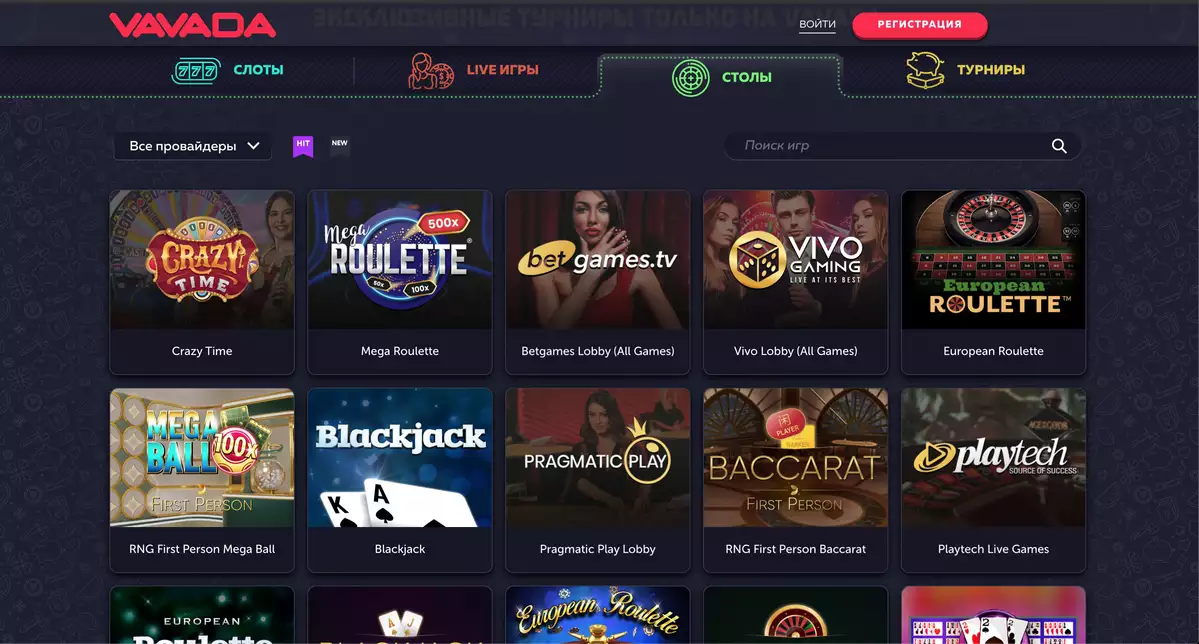

Live casino

Здесь вы получаете возможность зайти в лайв рулетку вавады и множество других тайтлов от пяти известных разработчиков. Лайв игры с ведущими представлены от таких провайдеров, как Pragmatic Play, Playtech, Vivo Gaming, Evolution и Betgames. Зарегистрированные пользователи могут легко в один клик открывать лобби этих компаний и ставить в избранных играх.

Столы и аркады

В столы вавада казино включены ставки против других игроков и дилеров в классике – блэкджек и покер. В данном разделе игрового меню найдете последние новинки в аркадах – бесплатные ставки на краш-тематику, мины, кено, spaceman, плинко, кости и многое другое.

На постоянной основе вы получаете шанс входить в турниры вавада, где разыгрывают несколько десятков тысяч долларов. В линейке доступны турниры на фриспины, кэш, Х и Х-плюс, а также по принципу максимальной ставки для срыва лучшей части призового фонда. На платформе действует принцип прогрессивного джекпота, победитель всех трех уровней определяется по принципу рандома, но для выигрыша джекпота нужно играть в слоты только в реальном режиме.

Вавада онлайн казино рабочее зеркало на сегодня

Компания заботится о положительном пользовательском опыте, в который включен такой кейс, как бесперебойный вход на платформу и доступ к денежным средствам в клиентском аккаунте. Блокировки площадок для гемблинга становятся постоянной тенденцией в индустрии, по этой причине есть вариант с открытием vavada зеркало. Это альтернативный адрес бренда в интернете, где полностью повторяется функционал и возможности игры основной версии. На сегодня вы можете узнать актуальные ссылки на проект у следующих источников:

- Саппорт. Открыв лайв чат на основной версии площадки (если все еще имеете доступ), сразу напишите о желании получить актуальное вавада зеркало сегодня. Вам быстро предоставят все необходимые доступы по запросу.

- Партнеры. Процесс игры в данной платформе показывают многие известные стримеры и блогеры. В описаниях их лайвов и видео нередко публикуют рабочие ссылки на дополнительные алреса клуба.

- Социальные сети. Компания активно ведет страницы в самых популярных социальных сетях для своего комьюнити гемблеров. В закрепленных постах всегда найдете зеркала проекта.

Еще есть возможность активировать рассылку на электронную почту, где специалисты заведения постоянно отправляют полезные обновления – новые слоты, запуск серий или крупных турниров, обновленное vavada рабочее зеркало и другие.

Бонусы Вавада

На сегодняшний день компания помогает всем новичкам добавиться успеха после регистрации профиля, также поощряет бетторов за неудачные игровые сессии и празднует день рождения своих клиентов. Ниже рассказываем все актуальные бонусные предложения заведения:

- Бездепозитный бонус vavada. Завершив открытие учетки и осуществив первую авторизацию, можете открыть ЛК и выбрать «бонусы». Система предложит активировать бездеп и зайти в игровой автомат Great Pigsby Megaways со 100 бесплатными вращениями, которые за 14 дней необходимо отыграть по правилу 20х.

- 100% на первое пополнение счета. Если новичок выполняет первый депозит, то получает возможность получить обратно введенную сумму в виде бонуса. Максимальное предложение клуба в рамках данной промоакции составляет 1000 долларов (или эквивалент в другой валюте). Сумму необходимо разыграть 35х.

- Ежемесячный кэшбэк. В начале каждого месяца действующие пользователи, у которых была зафиксирована череда неудач и больше проигрышей, забирают возврат денежных средств. Максимальный кэшбэк вавада составляет 10% с вейджером 5х.

- Бонус на день рождения. Если желаете получить 50 фриспинов на игровые автоматы, то в настройках профиля необходимо указать дату рождения. Вращения в игре Maya Mystery требуется отыграть пять раз.

- Промокоды. В социальных сетях бренда регулярно раздают промокоды, которые дают гемблерам новые пачки фриспинов в слотах.

Партнерская программа Vavada

У компании действует отличная партнерка, в рамках которой пользователи получают возможность продвигать бренд, приводить новых клиентов через свою реферальную ссылку и получать комиссионные выплаты. В модели CPA вавада казино будет зачислять денежные средства за каждое ценное действие вашего реферала. Долгосрочные выплаты откроются вам в модели RevShare – определенный процент от постоянных ставок приведенного вами беттора. Партнерские проценты зачисляют на аккаунты дважды в месяц, минимальный вывод денег установлен на 1000 рублей.

Вавада поддержка

Техподдержка доступна всем посетителям основного ресурса, а также официальных рабочих зеркал. В круглосуточном режиме имеете возможность пообщаться с лайв чатом. Среднее время ответа составляет около 15 минут, в момент пиковой нагрузки раздела будете ожидать реакции специалистов подольше. Служба поддержки вавада казино также предлагает свою помощь через электронную почту и номер телефона. Если чаще пользуетесь социальными сетями, то можете направлять свои запросы в аккаунт скайпа. У компании активные страницы в ВК, телеграме и инстаграме, где также готовы прийти на помощь и подсказать необходимые нюансы относительно возникших вопросов.

Дополнительно, в футере страницы представлены полезные ссылки, которые помогут вам быстро освоить ключевые положения гемблинга. В правилах найдете подробную информацию по бонусным промоакциям и турнирам, в ответственной игре представлены кейсы, как максимально избежать зависимости от азартных развлечений и ставить на игры казино разумно.

FAQ

Как подтвердить открытие аккаунта на vavada?

Для подтверждения открытой учетки есть два способа. Если ваш логин – номер телефона, то на мобильный получите сообщение с кодом. Если применили опцию с электронной почтой, компания отправит письмо с поздравлениями о создании профиля и попросит перейти по ссылке.

Как выигрывать в вавада казино?

Запомните, нет 100% гарантии выигрыша на сайтах казино, следуя нашим советам можете только увеличить шансы остаться в плюсе. Читайте правила компании, условия в каждой игре, ставьте в бесплатном режиме и воспользуйтесь бонусами заведения.

Какие бонусы раздает казино vavada?

За регистрацию профиля компания предлагает воспользоваться приветственным предложением. Бездеп идет в качестве 100 фриспинов, на первый депозит администрация зачислит бонус в виде использованной суммы до 1000 долларов. В начале каждого месяца будете забирать кэшбэк, еще действует подарок на ДР и промокоды vavada.

Как играть в вавада на андроиде?

Пользователи андроид смартфонов могут скачать мобильное приложение – ссылку забирают у лайв чата во время запроса. Еще есть хорошая адаптация игрового процесса и общего пользовательского опыта в мобильной версии казино.

Какие платежи предлагает vavada casino?

Для депозитов и выводов средств у вас есть несколько опций. Клуб поддерживает обычные зачисления и снятия с банковских карточек. Если желаете быстрее видеть средства на балансе и получать выплаты, то пользуетесь транзакциями на электронные кошельки и криптовалютой.

Отзывы

-

Мне нравится играть здесь, всегда есть бесплатные слоты и аркады, даже не требуется пополнять счет, грузишь в свое удовольствие

-

Служба поддержки, если честно, оставила неоднозначные впечатления. Вроде помогли решить вопрос, но отвечали максимально долго.

-

Оцениваю эту площадку на твердую четверку. До пятерки не дотянула из-за интерфейса, где все настройки быстрого выбора игр?

-

Бонусы – крупные, условия – сложные. Им стоит пересмотреть свои предложения, отыгрыш фриспинов и на первый депозит очень завышен.

-

Я был удивлен, когда мне зачислили бонусы за несколько месяцев игры тут. Главный плюс в том, что клиента ценят и это заметно невооруженным глазом.